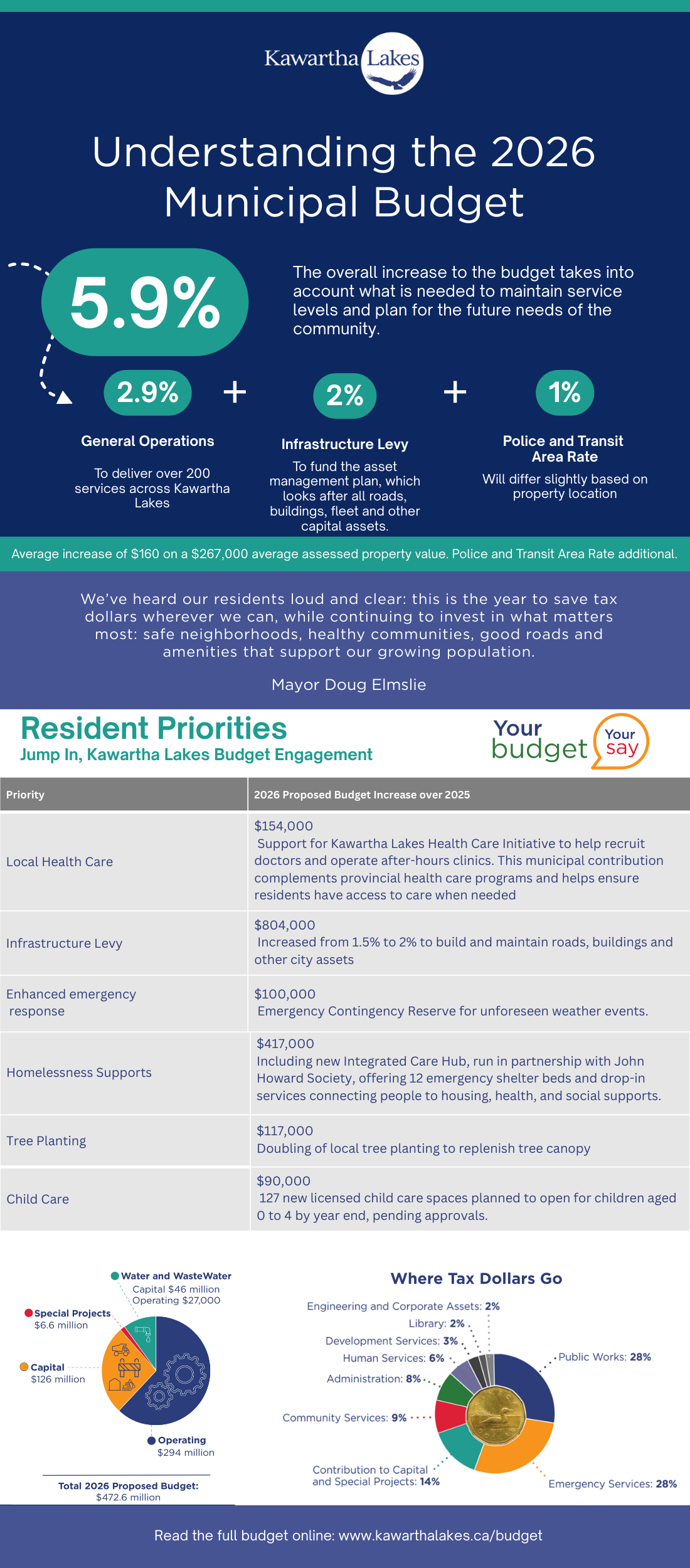

Read the Mayor's Approved 2026 Budget

Your Feedback

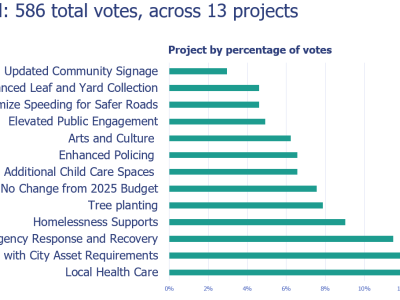

What Matters Most:

Residents’ Priorities for $1.6M in 2026 Budget Funding

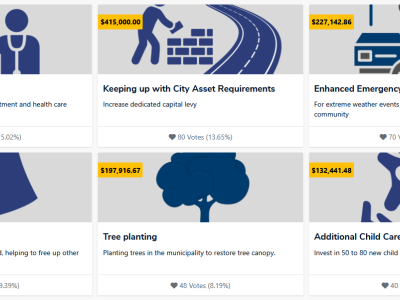

Your Feedback In Action

Your Top Funded Projects | Budget Increase Proposed

Background

1. The municipal budget is complex.

Watch a video series to explain the budgeting process, where the funds come from, how taxes are spent, and more.

2. It's helpful to think of the municipal budget like your household budget.

- Both households and municipalities must balance income and expenses, prioritize essential needs, and make choices about where to spend limited funds.

- Both plan for regular (operating) and improvement (capital) spending, and must plan carefully to avoid overspending.

- Municipal budgets, like household budgets, must be balanced—if expenses exceed revenues, service level cuts or tax increases are needed.

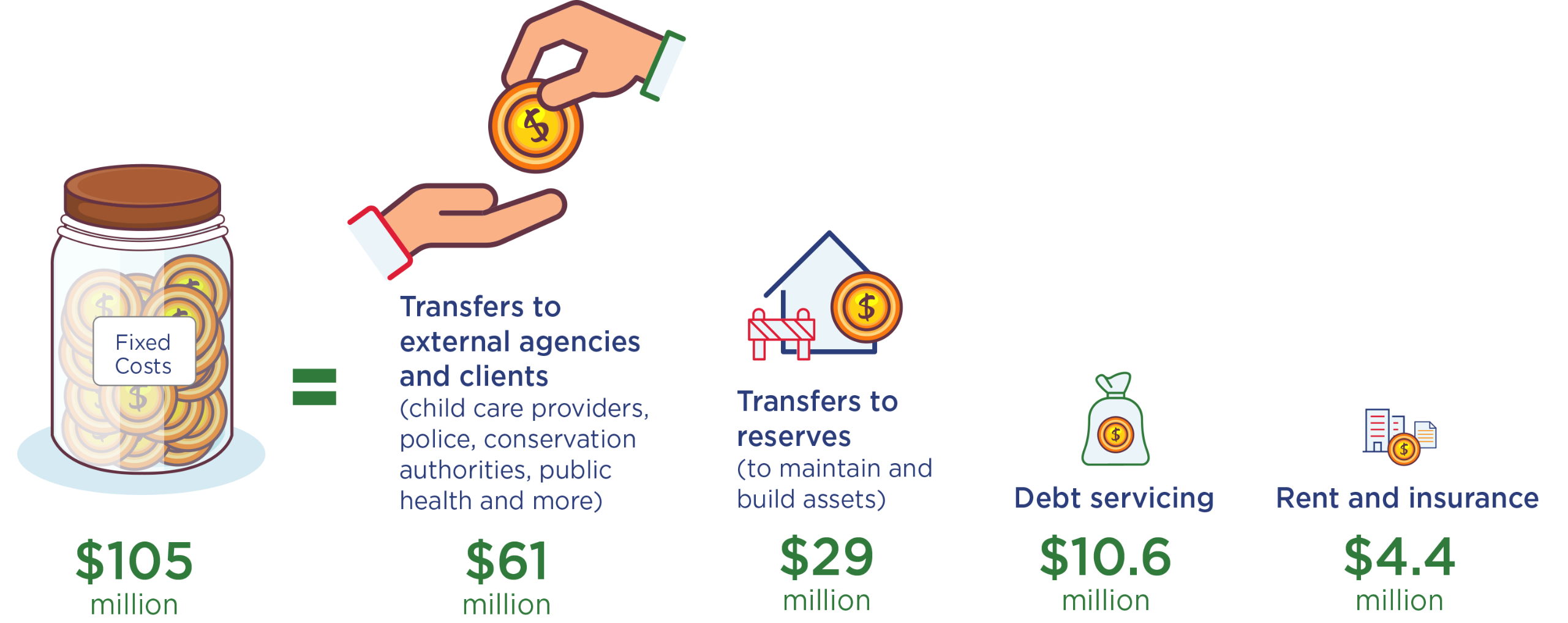

3. Municipal Budgets have fixed and variable costs.

The 2025 Budget had approximately $105 million in fixed costs, as shown below.

Fixed Costs

Variable Costs

While a large part of the municipal budget is fixed, either by previous Council decisions, or due to provincially mandated standards, a portion is flexible and can change based on service levels set by Council.

The flexible portion of the budget funds core services and programs, such as emergency services, parks and recreation, road improvements and maintenance, customer service and many of the services residents use every day.

Within these areas, the Mayor and Council have choices on where to spend additional funds to meet community priorities, and your voice helps guide those decisions. These additional funds may come from grants, user fees or funding from other levels of government, or they may come from increases to the tax levy.